2026 Schedule of Fees and Payment Information

The fees charged by the College are structured such that annual Fee and Levy amounts are invoiced to family accounts on a quarterly basis commencing in December each year, prior to the commencement of the following academic year.

Fees for each academic year are comprised of the below:

- Tuition/Program Fees

- Capital Levy

- Payroll Tax Levy

- Expeditions Fee (for Years 4 to 9 only)

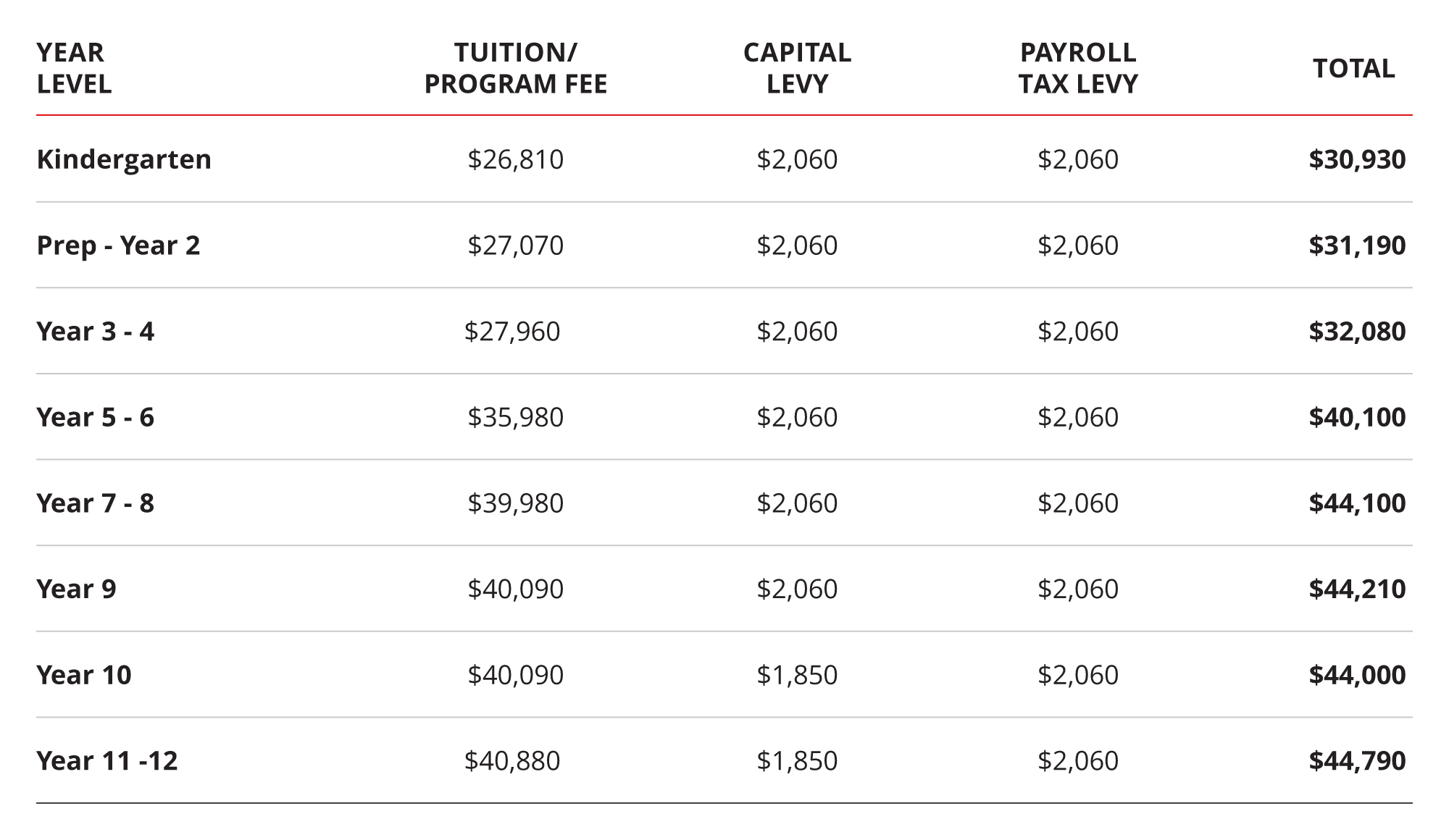

2026 Fees and Levies

Expedition Fees

Students in Years 4 to 9 undertake elevated Expedition experiences, the cost of which is invoiced separately to parents.

Please note:

- Costs of non-compulsory camps/trips, immersion experiences, artistic performances, etc are payable in addition to the above.

- Some small additional costs/charges may be applied to family fee accounts as required.

Quarterly fee invoices and statements

Please note that the College will provide an invoice/statement to families on 1 December, 1 March, 1 June and 1 September each year.

Payments options

The College accepts payments towards Annual Fees as follows:

- Early Payment - payment of all 2026 fees and levies prior to 31 December 2025.

- Quarterly Payments via BPAY - payments are due by 15 December, 15 March, 15 June and 15 September.

- Quarterly Payments via credit card using College Payments Portal - payments are due by 15 December, 15 March, 15 June and 15 September.

- Quarterly Payments via Direct Debit – payments will be scheduled to be deducted from your nominated bank account or credit card on 15 December, 15 March, 15 June and 15 September.

Any alternative to the above arrangements, being the payment of tuition/levies/program fees either via Early Payment or on a quarterly basis, must be addressed with the College Finance Department and confirmed by the Director of Finance & Business and/or Principal. In these instances, additional information may be required to be provided by families and any alternative arrangements agreed to will be confirmed via specific written agreement with the College.

Fee Discounts

The College offers a range of discounts – from an Early Payment Discount of 2.5% to Family Discounts for Tuition & Program Fees and the Capital Levy.

Compulsory Fees and Levies

Program Fees

The intention of our Program Fees are to specifically fund costs incurred in the provision of curricular, co-curricular and faith & service based programs and activities that relate only to students in particular year levels. Some of the major elements of the Program Fees are the additional costs for the APS sports program (including specialist sports coaches), classroom technology requirements for year levels that are not yet required to provide a privately owned computer, excursion and incursion costs, faith & service based retreats, compulsory music programs, etc.

Capital Levy

The monies the College receives in relation to this levy are used to fund its annual capital expenditure requirements.

Annual capital expenditure requirements of the College include facilities improvements, acquisition of information technology infrastructure and hardware/computers, various grounds and maintenance equipment, vehicles, significant items of sports equipment, minor improvements to existing classrooms and facilities, etc.

Payroll Tax Levy

The removal of the Payroll Tax exemption by the State Government from 1 July 2024 continues to have a significant financial impact to the College and its operations. The College has determined that it will continue to apply a Payroll Tax Levy to each student to fund this additional cost.

Additional Levies and Charges

Additional levies and charges will apply in relation to students participating in our rowing and snow sports programs as well as those undertaking various non-compulsory activities such as musical instrumental lessons and group performances, musical instrument hire, artistic/creative arts performances, specialist sporting programs, camps, etc.

Kindergarten

Our Early Years staff can provide further information in relation to availability of individual weekdays. Please note we operate under strict capacity requirements and will endeavour to meet your needs wherever possible.

Before and After School Care

We provide an out of hours care service for students on both a before (from 7:30am) and after school (3:00pm - 6:00pm) basis. The fee is $45 for before school care and $55 for after school care.

Contact Us

For questions and queries regarding family fee account or payments matters please contact the Finance Department on: 9854 5419, 9854 5415 or 9519 0658, or alternatively via email at accounts@xavier.vic.edu.au